Managing Money in Retirement I: How Much Can I Withdraw?

Welcome back, and Happy New Year!

My first posts covered how much to save for retirement. In the next several posts, I explore how to manage savings and withdrawals once you’re in retirement.

OK, so you’ve made the break, attended your last office party, and are no longer punching a clock. How should you handle your savings? How much can you withdraw and spend every year? Wait a minute, you say – didn’t the last couple of blogs already answer that question? Why not withdraw 4% of your savings in the first year, then increase that with inflation each year to keep the purchasing power the same?

Well, you would most likely do fine taking such an approach, which would have worked out anytime in the last hundred years or so. But there are some other possible strategies to consider, some of which may be even better – or may help you sleep better at night. Let’s take a deeper dive into the whole area of retirement distributions.

Sustainable Withdrawals

There are two schools of thought about retirement finance. One is the probability-based approach, which attempts to define a sustainable (or safe) withdrawal rate (SWR). This is the approach pioneered by William Bengen, and elaborated by a number of subsequent analysts, that resulted in the 4% rule.

The graph below shows an updated version of Bengen’s 4% analysis, done by Michael Kitces, that shows the very different sustained withdrawal rates that would have worked beginning in different years from 1871 to the present.

4% withdrawals would have worked out in the very worst years (late 1960s), and higher withdrawal rates would have been fine in many other retirement years. Still, as some critics have noted, the fact that the 4% rule would have worked in the past doesn’t mean it will necessarily always work going forward. A good track record is not a guarantee.

Also, the use of the 4% rule doesn’t take account of how your portfolio is actually doing. If you have a number of years of bad returns early in your retirement, it might be prudent to scale back your withdrawals. This is probably what most retirees would actually do if faced with this situation.

On the other hand, if you’re in your eighties and your investments have done well, you might be able to take more out than the rule suggests. In most past periods, the 4% rule would have resulted in a tidy ending balance – good if your goal is to leave a legacy, but not so good if you would have preferred to spend some of that money on foreign travel or other adventures on your bucket list.

In short, locking in a withdrawal amount without regard to the current status of your portfolio doesn’t seem ideal. So the 4% rule is a great guide to saving for retirement – but may have some shortcomings as a withdrawal strategy.

Safety First – Another Approach

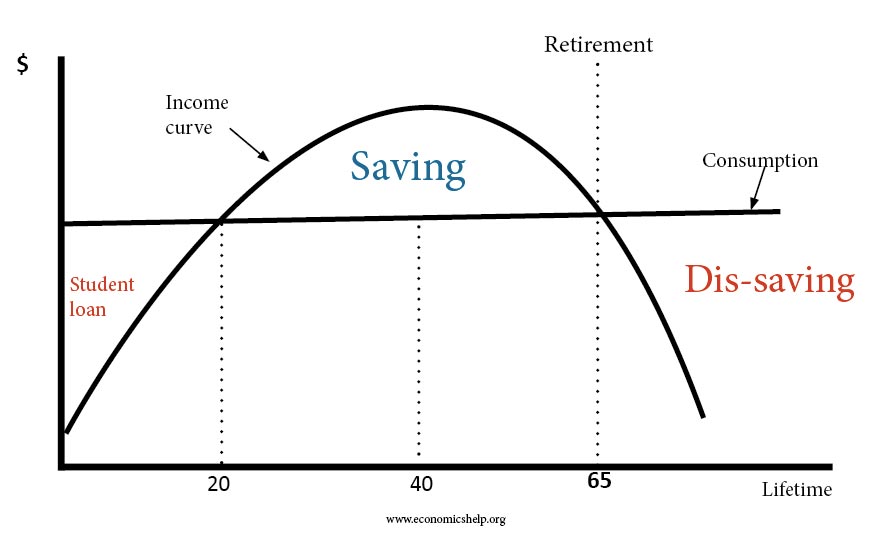

A second body of research on retirement, the safety first approach, is rooted in Lifecycle Finance Theory, associated with the work of economist Franco Modigliani in the 1950s, and more recently, Professor Zvie Bodie of Boston University. The lifecycle hypothesis states that people will attempt to achieve a relatively constant standard of living throughout their lives, saving during their productive working years and dissaving (i.e., spending!) in retirement, as shown in the diagram below. The theory predicts that a worker will save for retirement rather than buy that shiny Maserati now and live in a pup tent and eat spam later.

In Modern Retirement Theory, a relatively recent application of this approach, Jason Branning and M. Ray Grubbs define funding priorities for retiree spending, from highest to lowest priority:

- essential needs (what you must have to live);

- contingency funds (for emergencies);

- discretionary expenses (travel, entertainment); and

- legacy funds (what you hope to leave for your heirs).

The safety first approach says that investments should be aligned with needs. Essential needs (think food, housing, utilities, and the like) should be funded with low-risk, certain investments so that the money will be there when you need it. Discretionary and legacy needs can be funded via more speculative investments, such as stocks, real estate, or your cousin’s start-up. This approach of building a rock-solid income base for the essentials, with additional money invested more speculatively for those things that are nice to have, is sometimes referred to as a floor-and-upsidestrategy.

Must You Choose?

Is safety-first (or floor and upside) really so different from the sustainable withdrawal rate approach? Do you have to choose one or the other? Not in my opinion. William Bengen never said all your retirement income must come from investments; he merely developed a tool for determining how much you could safely withdraw to cover whatever expenses weren’t covered by social security or pensions. By the same token, the floor and upside approach acknowledges that, in addition to a floor of ‘certain’ income, retirees will typically need to manage their investments and determine how much is safe to withdraw each year.

In reality, most retirees probably end up with what might be viewed as a hybrid strategy, with some regular income that fits the safety first model (most Americans will receive Social Security) along with an investment portfolio to manage and draw down over time using (one hopes) a sustainable withdrawal scheme.

As a retiree, I know that I have a very different feeling about the pension income I receive than I do about the withdrawals I make from savings to cover the rest of my needs. A regular retirement check, much like a paycheck, is very reassuring – providing psychological as well as analytical support for the value of having a floor of ‘certain’ income. The importance of this assured income is, I think, the key insight and take-away from the safety-first school.

How do you assure yourself of this desirable stream of income in retirement? Stay tuned – my next post will explore this question.

References

Bengen, William P. (1994, August). Determining Withdrawal Rates Using Historical Data. Journal of Financial Planning.

Bodie, Zvi; Treussard, Jonathan; and Willen, Paul. (2007, May). The Theory of Life-Cycle Saving and Investing. Public Policy Discussion Papers – Federal Reserve Bank of Boston. No. 07-3.

Cotton, Dirk. (2018, January 26). Unraveling Retirement Strategies: Floor-and-Upside (An Update). Retirement Café.

Pfau, Wade and Cooper, Jeremy. The Yin and Yang of retirement income philosophies. Challenger.

Pfau, Wade. (2016, April 26). What Is a Safety-First Retirement Plan? Forbes.